PTAG Trucking Division

Welcome to Your Growth Hub

Welcome to our dedicated Trucking Resource Center—a space built specifically for the owner-operators and small fleet owners who keep the country moving.

We know that navigating the road is only half the battle; the other half is choosing the right path for your business. Whether you are looking to break into specialized hauling or maximize your efficiency in dry van freight, we are here to provide the insights you need. Explore our deep dives into various industry sectors and discover the tools, trends, and strategies designed to help your fleet thrive in today’s market.

Let’s drive your business forward, together.

Cost Per Mile

Operating a big rig is more than just driving; it's managing a mobile business where every penny counts.

The Cost Per Mile (CPM) is the heartbeat of your operation. If you don't know your CPM, you don't know if a load is making you money or costing you to haul it.

As of early 2026, the average total cost to operate a Class 8 truck is approximately $2.26 per mile, though this fluctuates based on fuel prices and equipment. cont.

*For the rest of this article and full data breakdown with expert insights, swing by our website on the trucking page today to check it out.

We appreciate your support and your dedication to the road. Join the PTAG organization now, together, we’re building a legacy for our veterans and less fortunate fellow Americans.

Big Beautiful Bill

Gear Up for Better Pay: The "Big Beautiful Bill" is Here!

Trucking just got more profitable. Thanks to the One Big Beautiful Bill Act, we’re helping our team keep more of their hard-earned money.

* Drivers: Federal income tax on your overtime and tips is now a thing of the past. That means more take-home pay for every extra mile you go.

* Owner-Operators: Take advantage of 100% Bonus Depreciation to write off your next truck immediately, plus a permanent 23% tax deduction on your business income.

Whether you're behind the wheel or running a fleet, the road to 2026 is paved with savings. Join a team that knows how to maximize your paycheck.

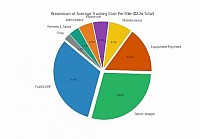

Cost Breakdown

1. The Cost Breakdown (Pie Chart)

The pie chart illustrates the distribution of your expenses.

• The Big Two: Fuel and Driver Wages consistently account for over 60% of your total operating costs. This is why fuel efficiency and driver retention are the two biggest levers for profitability.

• The Hidden Costs: Smaller slices like tires ($0.05) and permits ($0.08) might look insignificant, but over 100,000 miles, those "small" tire costs add up to $5,000.

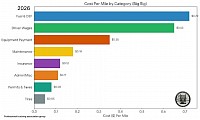

Expense Breakdown

2. Expense Impact (Bar Chart)

The bar chart ranks your expenses from highest to lowest. This helps identify which areas to target for cost-cutting.

• Variable Target: Fuel ($0.72) is your most controllable variable cost. Even a 5% improvement in fuel economy can save roughly $3,600 per year per truck.

• Fixed Target: Equipment payments ($0.35) are fixed. The best way to "lower" this cost is to increase your monthly mileage, spreading that payment over more miles.

Pro Tips

3. Pro Tips to Lower Your CPM

Small adjustments can save thousands of dollars over a year.

• Mind the "Sweet Spot": Most heavy engines have a "sweet spot" (usually around 60–65 mph) where fuel efficiency is highest. Increasing speed by just 5 mph can drop your fuel economy by nearly 1 MPG.

• Eliminate Deadhead Miles: Driving empty is the ultimate profit killer. Use load boards or backhaul apps to ensure your trailer is loaded as close to 100% of the time as possible.

• Tire Management: Under-inflated tires increase rolling resistance and kill fuel mileage. Check your pressure daily; it's the cheapest maintenance you can do.

• The Idling Trap: One hour of idling burns roughly one gallon of fuel. If you're parked, use an APU (Auxiliary Power Unit) or optimized idle settings to save $3–$4 per hour.

• Fuel Cards: Never pay the "sticker price" at the pump. Use fuel cards that offer "cost-plus" discounts, which can save you 30–60 cents per gallon at major truck stops.